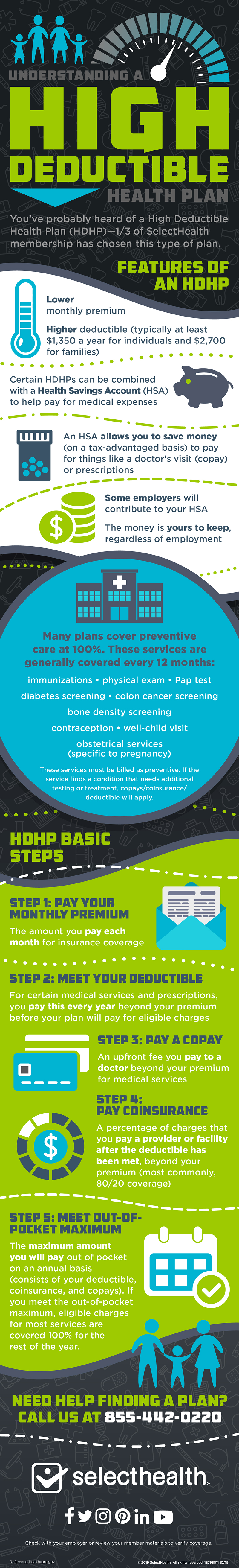

What’s considered a High Deductible Health Plan? Under the tax law, HDHPs must set a minimum deductible and a limit, or maximum, on out-of-pocket costs. For calendar year 2021, these amounts for HDHPs are: Minimum deductible (The amount you pay for health care items and services before your plan starts to pay). $100 copay per trip: Transportation by car, taxi, bus, gurney van, wheelchair van, and: any other type of transportation (other than a licensed ambulance or psychiatric transport van) is not covered. Urgent care $40 copay per visit: None. Facility fee (e.g., hospital. Room) $500 copay. .Under the High Deductible Health Plan (HDHP), your deductible is $1,500 for Self Only coverage, and $3,000 for Self Plus One or Self and Family coverage. With the exception of preventive care, vision and dental, you must pay the full deductible before GEHA pays for your health care. About HDHP Plans With a high deductible health plan (HDHP), your deductible is higher and your premium is lower. Instead of paying copays when you visit the doctor or have a medical service performed, you pay the cost in full—that is, until you meet your deductible. A High Deductible Health Plan (HDHP) has low premiums but higher immediate out-of-pocket costs. Employers often pair HDHPs with a Health Savings Account (HSA) funded to cover some or all of your deductible. You may also deposit pre-tax dollars in your account.

Take advantage of comprehensive coverage and funds you can use to pay for future health care expenses.

This plan pairs lower premiums with a health savings account (HSA) or a health reimbursement arrangement (HRA).

Why you might like the HDHP:

- Pay nothing for in-network preventive medical care.

- You pay only 5% of medical services after your deductible is met.

- With our premium pass-through, GEHA contributes to your HSA/HRA to lower your net deductible.

- Vision benefits are included and you pay nothing for in-network preventive dental treatment, which includes two checkups and one X-ray annually.

- Your in-network out-of-pocket maximum for 2020 is only $5,000 for Self Only, or $10,000 for Self Plus One or Self and Family.

2020 Rates

These rates do not apply to all enrollees. If you are in a special enrollment category, please refer to the FEHB Program website or contact the agency or Tribal Employer that maintainsyour health benefits enrollment.| Self Only | Self Plus One | Self and Family | |

|---|---|---|---|

| Non-Postal biweekly | $59.29 | $127.48 | $150.04 |

| Postal biweekly – Category 1 | $56.92 | $122.38 | $144.04 |

| Postal biweekly – Category 2 | $49.21 | $105.81 | $124.53 |

| Monthly (retirees) | $128.46 | $276.20 | $325.09 |

Like all GEHA plans, this plan covers 100% percent of preventive care costs if you see an in-network provider. Once you meet your annual deductible GEHA pays 95% of most in-network care.

If you have an HSA, you can make additional deposits into the account. Your savings can be invested through HSA Bank and continue to grow until you decide to use them.#

GEHA deposits $900 a year for Self Only; $1,800 for Self Plus One or Self and Family into your HSA or HRA.

Any HSA money you don’t spend can earn tax-free interest, allowing you to plan for future health expenses all the way through retirement. If you leave your current job or leave federal employment, any money in your account is yours to keep.

PreviousNextCosts for services in 2020

The table below summarizes your in-network cost for medical benefits with GEHA's High Deductible Health Plan. For complete information, refer to the GEHA Plan Brochure.Copays

| Copay | What you pay in-network |

|---|---|

| Primary physician office visit | 5% after deductible* |

| Specialist | 5% after deductible* |

| MinuteClinic (where available) | 5% after deductible* |

| Urgent care | 5% after deductible* |

| Routine eye exam | $5 through EyeMed |

Other services

| Service | What you pay in-network |

|---|---|

| Preventive lab services | Nothing |

| Well-child visits; up to age 22 | Nothing |

| Adult routine screening | Nothing |

| Preventive dental care; twice yearly | Nothing |

Maternity care

| Service | What you pay in-network |

|---|---|

| Routine provider care | Nothing after deductible* |

| Inpatient care | Nothing after deductible* |

| Self Only | Self Plus One | Self and Family | |

|---|---|---|---|

| Out-of-pocket-maximum (in-network) | $5,000 | $10,000 | $10,000 |

| Calendar-year deductible (in-network) | $1,500 | $3,000 | $3,000 |

| GEHA’s HSA/HRA premium pass-through contribution | $900 | $1,800 | $1,800 |

| Net deductible after pass-through1 | $600 | $1,200 | $1,200 |

1Your “net deductible after pass-through” is the bottom-line amount you owe for health care services before GEHA begins to pay. If you have GEHA’s High Deductible Health Plan, GEHA’s pass-through contribution reduces your net deductible.

Prescriptions

The table below summarizes your cost for prescription drugs with GEHA’s HDHP. For complete benefit information, including details on specialty drugs that are injected or infused, refer to the GEHA Plan Brochure.

To find a drug cost based on your benefit plan and prescription dosage, check your drug costs.

Retail pharmacy – 30-day supply

| In-network | Out-of-network | |

|---|---|---|

| Generic and preferred brand-name medication | 25% of plan allowance, after deductible*¤ | 25% of plan allowance, after plan deductible,* plus difference between GEHA allowance and the cost of the drug¤ |

| Non-preferred brand-name medication | 40% of plan allowance, after deductible*¤ | 40% of plan allowance, after plan deductible,* plus difference between GEHA allowance and the cost of the drug¤ |

Mail service pharmacy – 90-day supply

| In-network | Out-of-network | |

|---|---|---|

| Generic or preferred brand-name medication | 25% of plan allowance, after deductible*¤ | n/a |

| Non-preferred brand-name medication | 40% of plan allowance, after deductible*¤ | n/a |

*Under the High Deductible Health Plan (HDHP), your deductible is $1,500 for Self Only coverage, and $3,000 for Self Plus One or Self and Family coverage. With the exception of preventive care, vision and dental, you must pay the full deductible before GEHA pays for your health care. You can use funds in your health savings account or health reimbursement arrangement to cover your deductible and other medical expenses.

¤If you choose a brand-name medication when a generic is available, you will be charged the generic copay plus the difference in cost between the brand-name and the generic.

VISION BENEFITS

Hdhp Vs Copay

HEALTH REWARDS

^GEHA supplemental benefits are neither offered nor guaranteed under contract with the FEHB, but are made available to all enrollees and family members who become members of a GEHA medical plan. For information on year-round savings for GEHAdental members, visit Savings for GEHA dental members.

This is a brief description of the features of the GEHA High Deductible Health Plan (HDHP). Before making a final decision, please read the Plan’s Federal brochure RI 71-014.All benefits are subject to the definitions, limitations and exclusions set forth in the Federal brochure.

With a high deductible health plan (HDHP), your deductible is higher and your premium is lower. Instead of paying copays when you visit the doctor or have a medical service performed, you pay the cost in full—that is, until you meet your deductible. Check out the Glossary of Terms for definitions of deductibles, copays, coinsurance and out-of-pocket maximums.

Hdhp Vs Copay Calculator

An HDHP does not mean less care or less coverage. It means that you pay only for the care you use—without prepaying for care that you may not use like in a PPO plan.

Important Points

- Preventive services are covered at 100% by the plan, and your deductible does not apply.

- All services—including office visits and the full cost of prescription drugs—are subject to the deductible. This means you pay 100% of all costs until you have satisfied the deductible.

- If you have family coverage, the family deductible must be satisfied before any individual receives benefits.

- After your deductible is satisfied, you begin sharing expenses with the plan – that’s coinsurance. You pay a small percentage of the expenses and any copays after your deductible is met. The plan begins paying the larger portion of your covered expenses. (In the Ascension Network, your coinsurance is 0%.)

- After you satisfy the deductible, there are copays for emergency room and urgent care center visits and prescription drugs. These copays apply until you reach the out-of-pocket maximum.

- After you reach the out-of-pocket maximum, the Plan pays 100% of covered expenses for the rest of the calendar year. If you have family coverage (any dependents), the family deductible must be met (by one person or by all family members together) before the plan begins to pay a share of the covered expenses. In other words, coinsurance does not begin for any covered member’s expenses until the entire deductible is met for all covered members of the family.

Paying for Your Expenses: Health Savings Account (HSA)

If you choose a High Deductible Health Plan, described above, and do not participate in another health plan, you can set aside money in a Health Savings Account.

The Health Savings Account is designed to help you pay for your medical expenses, particularly to help toward your deductible and cost sharing expenses. The HSA can also be used to pay for other qualified health expenses such as dental and vision expenses. Both you and your health ministry may make contributions to the HSA. (The contribution limits are set each year by the IRS and may change.) You can use the money in your HSA to pay for qualified expenses now or you can keep the money in your account and use it to pay for future expenses.

HSA: Tax-Advantaged Health Accounts for HDHP Plans

Hsa Vs Ppo Calculator

SmartHealth’s High Deductible Health Plans (HDHP) include a Health Savings Account (HSA).The HSA allows for both employer contributions and associate contributions that you can use for medical, prescription drug, dental or vision expenses. You never lose the contributions if you don’t use them.

Important to know:

- If you are enrolled in Medicare, are covered by TriCare, are covered by another plan (which is not a high deductible plan) or you are claimed as a dependent on another person’s coverage, you may not open a new HSA or contribute to an existing HSA.

- In order to receive employer HSA contributions, you MUST open an HSA account and you MUST contribute at least $26 per year. Shortly after you enroll in a SmartHealth HDHP, you’ll receive an HSA welcome kit in the mail. You’ll need to complete and return the signed forms within 10 days of receiving your materials to comply with federal regulations.

- If you do not open an HSA account, you may choose to contribute to the Health Care FSA. However, you may not be able to receive employer contributions.

| Account | HSA | FSA |

|---|---|---|

| Available with SmartHealth plans | HDHP | PPO or HDHP |

| Who owns the account | Associate | Ascension |

| Who funds the account | Ascension and Associate | Associate |

| Limits | *$3,400 individual coverage *$6,750 family coverage | $2,550 |

| Ascension Contributions | $500 for individual coverage plus up to $400 in wellness rewards $1,000 for family coverage plus up to $400 in wellness rewards | N/A |

| Fund availability | As contributed each pay period | Annual amount available immediately |

| Carry-over limits | No limit on carry-over of unused funds | Limit of $500 annual carry-over of unused funds |

| Portable (available after termination of employment) | Yes | Yes, if you elect COBRA continuation |

| Interest bearing | Yes | No |

Hdhp Copays And Deductibles

*Limits are combined annual limits of both employee and employer contributions to all HSA plans. This includes any amount contributed by Ascension to the HSA.Aim for the Best Care at the Lowest Cost

You do not select a network or a doctor when you enroll. You choose a network when you need care, and you receive the level of coverage provided through that network. Each SmartHealth option offers you access to these providers:

Ascension network of physicians and facilities. You will benefit from the lowest-cost care when you use Ascension network providers. Because we are a health care provider, our medical plans are able to offer a higher level of coverage for most types of services than other employer’s plans. To assure you are able to take the greatest advantage of our plans’ savings, select a primary care physician for yourself and each of your covered family members from the Ascension Network. To view the physician directory, go to mysmarthealth.org.

A national network of providers. The benefits coverage available when you receive care from a provider in our medical plan’s National Network is designed to be comparable to other employer’s in-network coverage. The national network of providers is there to provide coverage when:

- you choose a provider who is not in the Ascension Network or

- when the care you need requires a provider who is not available in the Ascension Network.

To find a physician or facility in the national network, visit the website listed on your medical plan ID card.

Hdhp Copay Accumulator

Out-of-network providers. If you choose to use a provider who is not contracted with the Ascension network or the national network of providers, then you will pay at least half the expenses for the care you receive out-of-network up to the out-of-pocket maximum. However, out-of-network coverage is available in all medical plans.